| Planes, trains & automobiles

Getting to know Boeing Capital Corporation

BY RUSS YOUNG

Helping

to establish a broader global presence for Boeing can sometimes be a lonely

job … just ask Cian Dooley. Helping

to establish a broader global presence for Boeing can sometimes be a lonely

job … just ask Cian Dooley.

Dooley is senior director–Europe for Boeing Capital Corporation,

and is the sole occupant of the company's office in Dublin, Ireland's,

vibrant financial district. Along with a Commercial Aviation Services

field representative, he makes up the entire Boeing presence in Ireland.

"Sometimes it feels like Seattle is a lot farther than 7,000 kilometers

(4,350 miles) away," said Dooley. "But being connected electronically,

and having the opportunity to regularly visit our offices in Renton, helps

bridge the gap. Fortunately, it helps to know that there are 174,000-plus

others on your team."

Thomas Hansen can relate. He inhabits Boeing Capital's one-person office

in Stockholm, Sweden, where the rest of the Boeing in-country contingent

is two CAS field representatives at Arlanda Airport.

Yet the presence of Dooley and Hansen in their respective cities, along

with the other "count-the-employees-on-one-hand" Boeing Capital offices

in Brussels, Hong Kong, Atlanta, Austin, Chicago, Detroit and New York,

is a key element of the business unit's long-term vision.

"We are establishing ourselves as a premier, global, full-service financier,"

said Boeing Capital President Jim Palmer. "We have a small — but

growing — number of offices in major financial and industrial centers,

and have our eye on other locations around the world.

"Having

talented team members who are readily accessible to customers and investors

is a vital part of fulfilling our vision, because financing is really

a people business," Palmer said. "Our competitive advantages are the talent

and experience of our employees, and the strength of the Boeing brand." "Having

talented team members who are readily accessible to customers and investors

is a vital part of fulfilling our vision, because financing is really

a people business," Palmer said. "Our competitive advantages are the talent

and experience of our employees, and the strength of the Boeing brand."

Boeing Capital has leveraged those advantages well since being elevated

to be one of three new Boeing business units in late 2000. Since the end

of 1999, the Boeing Capital portfolio — the total value of the airplanes

and commercial equipment it owns and leases, plus the value of outstanding

loans — has more than tripled to approximately $10 billion. During

2001, revenues increased 48 percent to $663 million, with Boeing Capital's

net income growing 42 percent to $152 million.

Boeing Capital and the financing business may seem somewhat mysterious

and exceedingly complex to many people, but Palmer says the basics of

the business are relatively simple.

"We generate cash from our own operations, in the form of loan and lease

payments. We also receive equity contributions, which are essentially

investments directly from The Boeing Co.," said Palmer. "But the majority

of our capital comes from issuing corporate bonds, which are purchased

by investors with the promise that we will pay interest on a scheduled

basis and pay off the principal amount when the bond matures."

Using

those funds, Boeing Capital offers two kinds of leases — long-term

and operating leases — and loans, also known as notes. Customers

may choose to borrow for the outright purchase of an airplane, satellite,

ship, machine tool or a wide variety of other equipment types, or they

may choose to lease the same item(s) from Boeing Capital. Long-term leases

are essentially a lease-to-own agreement, while operating leases represent

more of a rental arrangement. Using

those funds, Boeing Capital offers two kinds of leases — long-term

and operating leases — and loans, also known as notes. Customers

may choose to borrow for the outright purchase of an airplane, satellite,

ship, machine tool or a wide variety of other equipment types, or they

may choose to lease the same item(s) from Boeing Capital. Long-term leases

are essentially a lease-to-own agreement, while operating leases represent

more of a rental arrangement.

Boeing Capital currently has 40 percent of its portfolio in long-term

leases, 33 percent in operating leases, and the remaining 27 percent in

the form of notes and loans.

Although many people may identify Boeing Capital with its role in financing

7-series aircraft, commercial airplanes represent only 70 percent of the

business. In addition to providing, and/or arranging financing for Commercial

Airplanes customers, the Renton-based Aircraft Financial Services group

has a fleet of nearly 300 airplanes under lease, as well.

"I believe that a lot of people think we exist just to provide financing

for Boeing Commercial Airplanes customers. That's part of our mission,

but it's important to understand that our decisions are made independently

and our Boeing-related transactions are at market rates," said Palmer.

"We are not what is often referred to as ‘the lender of last resort'

— the source of financing for people who can't get it anywhere else.

Boeing Capital is responsible for generating profits for The Boeing Company."

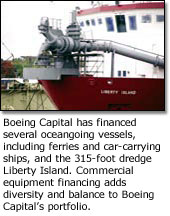

There also is a decidedly different side of the Boeing Capital business

that most people aren't aware of — the financing of commercial equipment,

such as business aircraft, oceangoing vessels, truck-and-trailer fleets,

and manufacturing, mining and other commercial equipment. The Long Beach-based

Commercial Financial Services group is responsible for such transactions,

which represent about 30 percent of the portfolio.

Palmer

explains that the rating agencies that establish and monitor Boeing Capital's

credit ratings, and subsequently the pricing of its corporate bonds, like

to see that the company is maintaining a healthy balance between Boeing

products and other types of equipment in case of an aerospace industry

downturn. Palmer

explains that the rating agencies that establish and monitor Boeing Capital's

credit ratings, and subsequently the pricing of its corporate bonds, like

to see that the company is maintaining a healthy balance between Boeing

products and other types of equipment in case of an aerospace industry

downturn.

"Plus, the worldwide commercial financing market is very big, and growing

steadily," Palmer said. "There are opportunities for profitable growth."

The third, and newest, business group within Boeing Capital is Space and

Defense Financial Services. Based in Long Beach, this small-but-active

team works closely with Boeing Satellite Systems and Boeing Launch Services

in providing and arranging financing for satellites and launches.

The group also is involved in arranging lease financing for military transport

airplanes, having placed four Boeing C-17s with the United Kingdom's Royal

Air Force. It also is working closely with the Military Aircraft and Missile

Systems business unit in a proposed 767 tanker lease to the U.S. Air Force.

"It's another example of us leveraging our core strengths, especially

our knowledge of aerospace products and customers," said Palmer. "We'll

continue building on those strengths, developing additional expertise

in our three primary areas."

Palmer stresses that businesses such as consumer credit cards and home

mortgages are well outside of that core, and Boeing Capital isn't interested

in pursuing them.

"We're growing quickly, but in a prudent and profitable manner," Palmer

said. "New business opportunities that supplement our core businesses

are one of the ways that we can sustain that growth, and make our contribution

to Boeing's overall growth and transformation. Expanding the number of

cities — and countries — that we have offices in, and increasing

the size of those offices, is another growth strategy."

|